Free Accounting Software

Everyone understands that they need to manage their finances but many people do not keep up with this task as often or as well as they should. This is mostly due to the fact that many people are simply overwhelmed with their financial information and have no idea how to keep track of it. Some people hire personal accountants to manage their money for them but the majority of people cannot afford such luxuries. Fortunately, there are many free accounting programs out there that can manage personal finances almost as well as a professional accountant. This article will list several of these programs.

Note: This article is focused on personal accounting. For a list of free business accounting software, please visit http://www.topbits.com/business-accounting-software.html .

Mint

Mint organizes the user’s expenditures into a variety of categories and displays those categories in a convenient and informative graph. Mint can be used to create a budget, track savings, and prepare a strategy to get out of debt. Mint can keep track of savings, investments, income, bills, loans, taxes, and more. The program also safeguards your financial information with the same security systems that major U.S. banks and other institutions provide. Most importantly, it’s completely free.

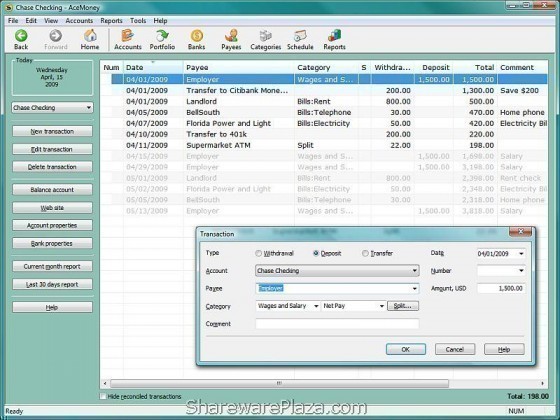

AceMoney Lite

AceMoney Lite is the free version of AceMoney and the only thing that it is lacking from its counterpart is the ability to create and manage multiple accounts. AceMoney Lite is all about organization and allows the user to maintain their financial information through the use of categories, calculations, and reports. AceMoney Lite is intended for personal use but is powerful enough for a small business. The program allows the user to track their spending habits, create and manage budgets with over 100 default spending categories, keep track of investments, exchange currency rates, connect to their online banking system, set calendar dates that alert them when a bill is due, protect their financial information with sophisticated password-protected software, automatically backup their financial information on a regular basis, plan payments, and even automate ecommerce.

JabpLite

JabpLite is a Java-based personal accounting program that can be used on mobile devices such as cell phones, blackberries, PDAs, and smartphones. JabpLite allows the user to create multiple accounts, track their investments, calculate their net worth, and even see a list of their top ten expenditures. The program comes with a plethora of default categories but also allows the user to create their own. It handles standing orders, future balance calculations, and FX currency rates that automatically update themselves to match the market.

HomeBank

HomeBank allows its users to keep track of their personal finances through the use of visual charts, graphs, and reports. It also allows the user to create categories depending on their specific financial needs. HomeBank has been available to the public for 14 years and is currently available in 57 languages. HomeBank runs in Linux, FreeBSD, Windows, Mac OSX, Amiga, and even in the mobile operating system, Nokia OS. HomeBank can manage multiple accounts and features customizable themes.

Metalogic Finance Explorer

Metalogic Finance Explorer is for users who need a personal accounting software and prefer a Windows Explorer-based atmosphere. Metalogic Finance Explorer is completely free and allows user to separate their finances into multiple categories which include overall budget, personal bank statements and activity, pocket cash, credit card usage and bills, investments, loans, and whatever else the user needs to keep track of. With personalized accounting features and customizable records, Metalogic Finance Explorer can be used to meet any and all personal accounting needs. The program also includes an online tutorial and helpful wizards that guide the user through setting up and managing their own personal accounting system.

Grisbi

Grisbi is another free personal accounting program that can be used in either Windows or Linux. Grisbi can be used to maintain multiple accounts, manage multiple users, and convert currencies in the blink of an eye. Grisbi can manage cash flow, expenditures, profits, income strategies, and more while allowing the user to keep track of how much they are earning and how much they need to earn to stay out of debt. While Grisbi cannot handle double-entry accounting, it does keep a record of financial years, bottom lines, and receipts.

Comments - No Responses to “Free Accounting Software”

Sorry but comments are closed at this time.