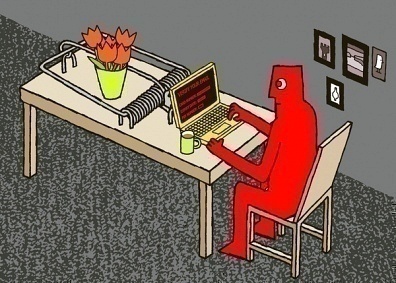

Email Scams

Email scams are illegal schemes that are operated and run through the Internet. The scammers send legitimate-seeming email messages to random email addresses. The content of the email varies but the object is the same: to separate gullible people from their money.

Email Scam Messages

Some email messages tell the recipient that they have won a very large prize in an international raffle. The scammer may use the name and logo of an internationally recognizable institution. There would usually be a deadline for claiming prizes, a contact number and, later on, demands of money for opening an account, paying taxes, bank service charges, etc.

There are also email scams that ask the recipient for help in transferring a large amount of money into a bank account in exchange for a very generous commission. The sender masquerades as a wealthy philanthropist, a bank manager, etc. who merely wishes to honor the deceased owner’s wish (or his wish, if the sender is supposedly the owner) that money be transferred to an overseas bank account so that a son can be sent to hospital or so that the authorities won’t be able to get their hands on it.

Why Email Scams Work

Recent studies by motivational psychologists indicate that the real problem in spam scam lies with people who are, in a way, “vulnerable” to scams. These people are ignorant about the Internet, computers and acceptable business practices.

Beyond the matter of inexperience in how the Internet works or how legitimate companies operate, email scammers also make use of various “motivational triggers” to push people into buying their products, or giving up confidential, personal information (including credit card numbers and passwords) to scammers.

Among these motivational triggers are:

- The promise of positive outcomes or pleasure if the spam recipient ‘buys in’ to the offer. Examples of such scams are get-rich-quick schemes, “hot” stock tips (with the scammer offering to act as broker), no-effort weight loss plans and ‘sexual performance boosters;’

- The promise of dire consequences if the recipient does not act quickly. For example, emails supposedly coming from the recipient’s bank or credit card company with a heading like “Your credit card may be compromised” would be enough for most people to open the message.

- Combining both fear and pleasure is a third ‘trigger’ – offering ‘cheap’ medicines (which playon one’s fears of becoming ill while offering a means to save money) is one such scam which has taken in a lot of people.

Aside from the above motivational triggers, scammers also use sophisticated methods to deceive people. Many scammers make an effort to project themselves either as legitimate businesses that the intended victims deal with (e.g., credit card companies, banks and so on) or as friends, business acquaintances or ‘long-lost’ relatives. This, combined with authoritative language is often enough to get people to open the email without thinking and thus unknowingly letting scammers gain access to their computers or giving up confidential information which can be used to ‘validate’ their identities.

Phishing Scams

These scam emails come into the inbox of unsuspecting people and they look as though they are from a legitimate business that you already have an account with such as financial organizations, banks, Paypal, even eBay. The email usually w

ill ask the recipient to update their personal information so that the company can update their database. Having a link that the recipient will click on will usually carry out the scam. This link will take the reader to a legitimate looking website with a similar address in the address bar. The unsuspecting reader would then login or update his or her personal information not knowing that they have just given their personal information to a phisher or scam artist.

Phishing scams are one of the fastest growing problems on the Internet and many people are falling victim to this type of scam every day. Phishing scams have resulted in people giving up information such as passwords, credit card numbers, bank account numbers, ATM pin numbers, social security numbers, even the mother’s maiden name used to secure a handful of accounts. Unfortunately, firewalls or virus protection programs do not generally block these emails as the emails don’t contain any suspicious code that would call attention to them. Spam filters also o not catch the emails because the emails all appear to come from legitimate sources.

Because there are not ways to block these emails, its easy to see why scammers and hackers use the phishing methods. Phishers are smart in that they focus on using legitimate companies and are able to imitate their website and emails when they request that people update accounts or provide personal information. Companies such as American Online, Bank of America, Wells Fargo Bank, eBay, PayPal, Best Buy, Washington Mutual, Comcast, and MSN have all been the targets of scammers in the past.

Because we are all familiar with these big names, we’ll usually trust emails or requests for information that come from them. The scammers are able to produce fake websites that look just like the real thing right down to the submenu titles, disclaimer, copyright notices, and other details big and small. Sometimes the only tell tale sign of fraud is the web address. Small differences will be hard to spot unless you are looking for them. For example, phishers will use a number one instead of a lower case L, like paypa1.com instead of paypal.com, which is a very subtle difference.

The term “phishing” refers to the use of legitimate looking sites as a bate much like a fisherman uses a bait to catch fish. Once the user “bites”, and provides information, they’ve been caught. The best way to avoid phishing scams is to be careful when you receive emails that are asking for personal information, updates of personal data, or other requests that you are not accustomed to getting. You should also try not to provide any personal information just because an email asks you to do so. You should be able to check the company’s website, not by link, or even call the company to ask why they would need information updated. Most companies, aware of the phishing problem, stress that they themselves will never ask for personal information in an email so if you get such an email from what appears to be them it must be a scam.

Here are some easy points which help you to avoid phishing:

- If you receive any email asking you to update your personal billing information try not to reply or click on any links in the email body.

- Check for misspelled words or any other mistakes in the links URL or company website name.

- If you think the email is a legitimate one, call the company’s customer service department and verify it before providing any personal information in the site.

- If you believe that it is a legitimate mail, before you provide any sensitive information in the website check for the “lock” icon on the browser’s status bar. This is to ensure that the information is secure during transmission.

- If you unknowingly supplied any information, contact your credit card provider and bank without any delay.

- You can forward any suspicious emails to uce@ftc.gov

In the end, only close attention to detail can help prevent making you a victim of phishing scams. If in doubt, contact your company by phone to inquire about database updates and the need for your personal information.

Comments - No Responses to “Email Scams”

Sorry but comments are closed at this time.